1. Overview

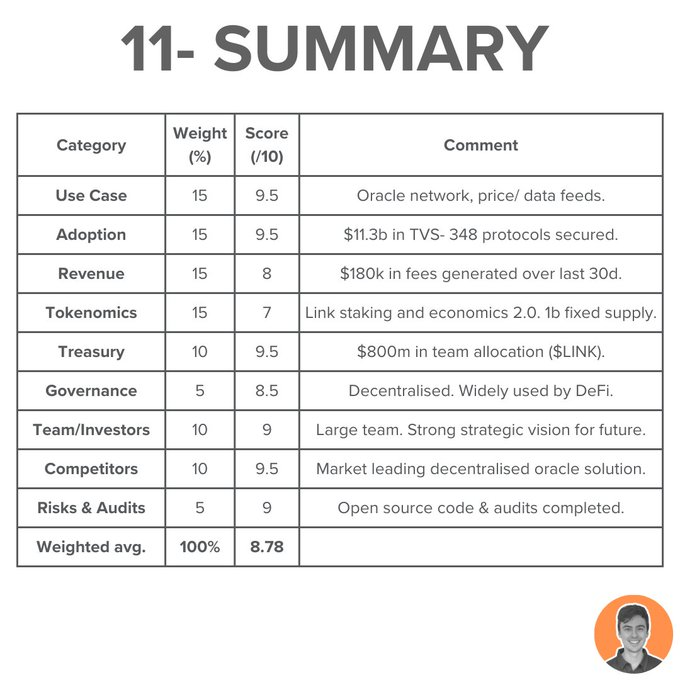

Chainlink is a decentralised oracle network that connects smart contracts to the real world.

It's infrastructure is widely adopted and used for:

• Price feeds

• Data feeds

• Proof of reserves

• Smart contract automation

• Verifiable on-chain randomness (VRF)

2. Use Case

Chainlink is widely utilized across various industries, including:

• Financial services

• DeFi

• Gaming

• NFT collectibles

• Climate markets

• Enterprise

• Insurance

It is among a handful of crypto projects that are critical for a robust and decentralized future.

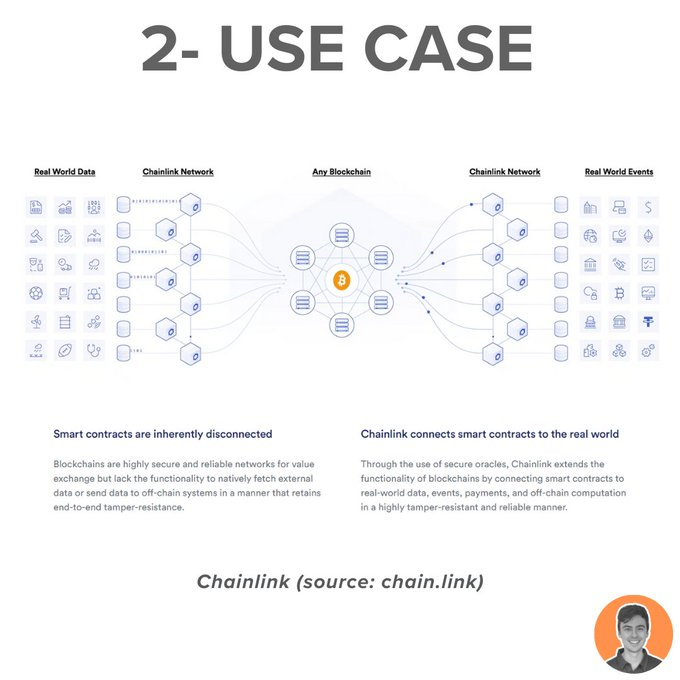

The launch of CCIP has been a game-changer for Chainlink, enabling seamless transfer of data and value between existing systems and both public and private blockchains.

The adoption of CCIP continues to surge:

• Base chain

• ANZ/ SWIFT

• Vodafone

• DTCC

• Affine Pass NFTs

3. Adoption

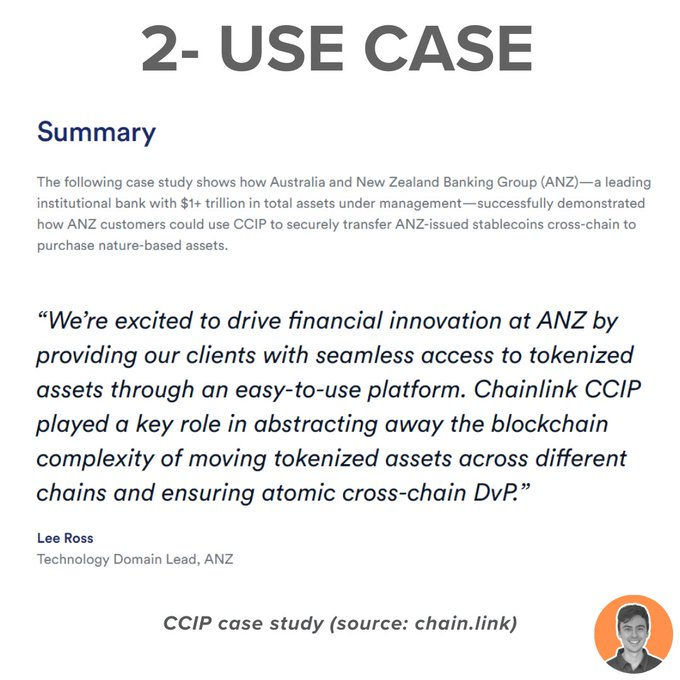

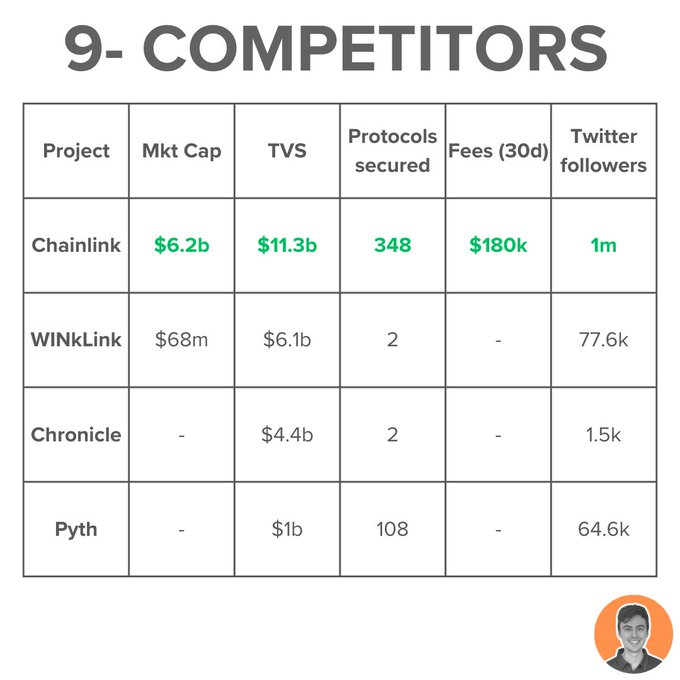

The current Total Value Secured (TVS) using Chainlink oracles stands at $11.3b (across 348 protocols).

Chainlink is the dominant and most widely used oracle, capturing over 46% of the market share.

Other notable oracles in the space include WINkLink, Chronical, Pyth, and TWAP.

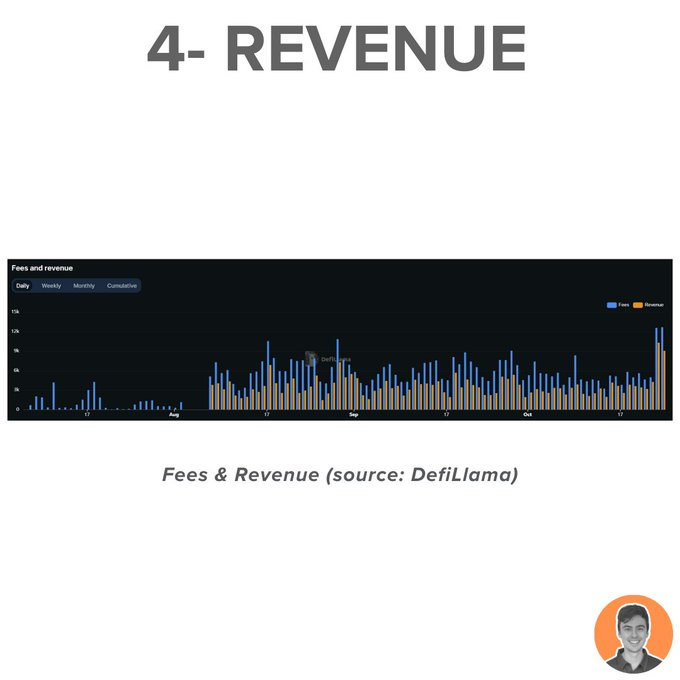

4. Revenue

Chainlink accrues fees and rewards through several methods:

• CCIP

• Keepers

• Requests

• VRF V1

• VRF V2

In the past 30d, Chainlink has generated:

• $180k in fees

• $111k in revenue

This places it at the top among other oracles and 71st overall according to DeFiLlama.

5. Tokenomics

The $LINK token is used within the network for the following components:

• Node operator fees

• Implicit staking

• Explicit staking

The recently released Chainlink 2.0 aims to create a new era of growth through:

• Chainlink Staking

• BUILD Program

• SCALE Program

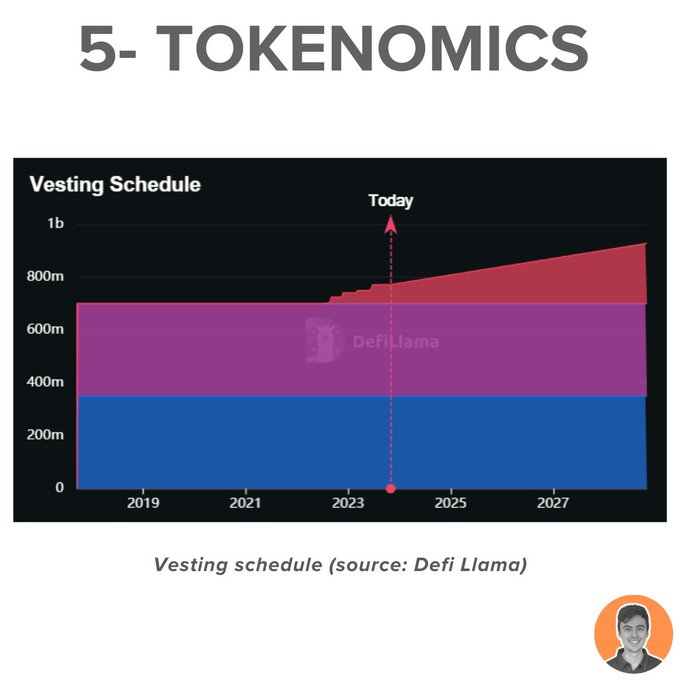

These are the current supply stats:

• Circulating supply = 556.8m

• Max supply = 1b

• Market cap = $6.1b

• FDV = $10.9b

• Market cap/ FDV = 0.56

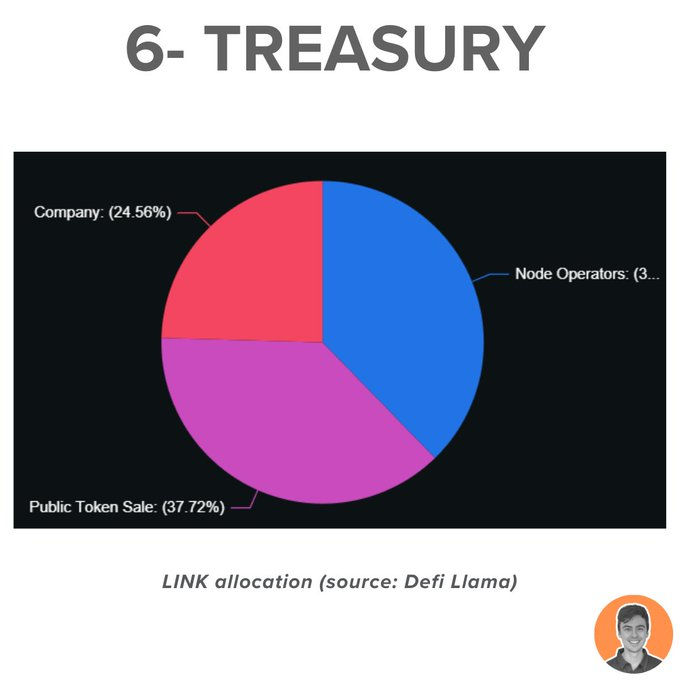

6. Treasury

Chainlink has allocated team tokens, which make up 30% of the total supply, to fund development.

Based on current prices:

• $72m $LINK

• $800m USD

According to DefiLlama, this would position it as the fifth largest in terms of Treasury value.

A substantial war chest.

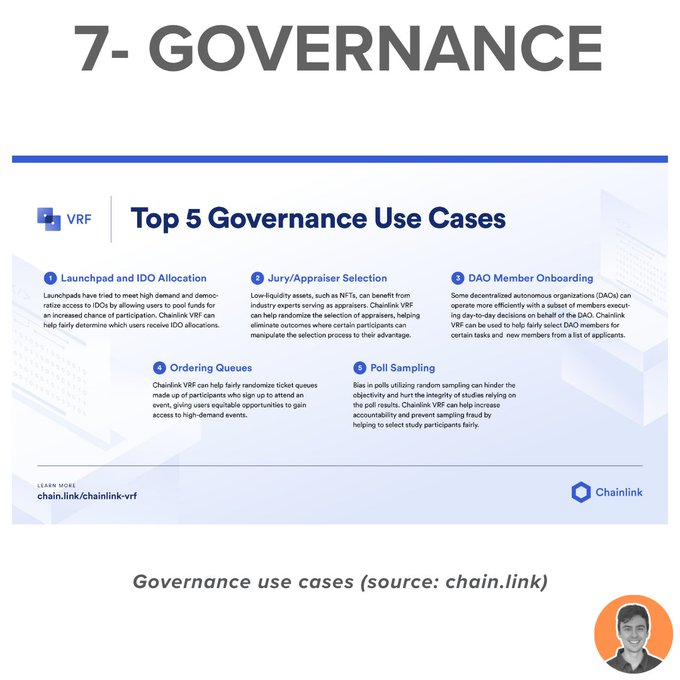

7. Governance

Governance is facilitated through validation, which monitors on-chain Oracle behavior and helps users choose oracles.

Chainlink products are also widely used by other DeFi projects to assist in their own decentralised governance.

8. Team & Investors

The project was founded in 2014 by @SergeyNazarov and Steve Ellis.

Chainlink Labs has since expanded to employ over 400 individuals.

To date, the project has successfully raised $32M in funding through four rounds.

9. Competitors

Chainlink is the market-leading oracle solution, enjoying a significant first-mover advantage and dominant market share (46% of TVS).

Considering the team's continuous growth and ecosystem development, I don't anticipate this changing anytime soon.

10. Risks & Audits

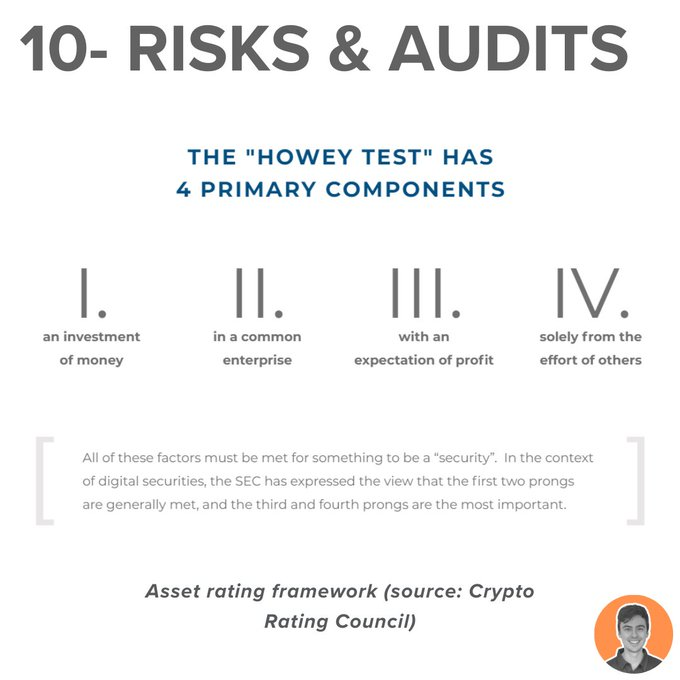

The codebase and smart contracts have undergone multiple audits throughout the years.

As per the CRC, Chainlink has been assigned a 2/5 rating in its securities framework.

A score of 1/5 indicates that it is least likely to be considered a security under the Howey test.

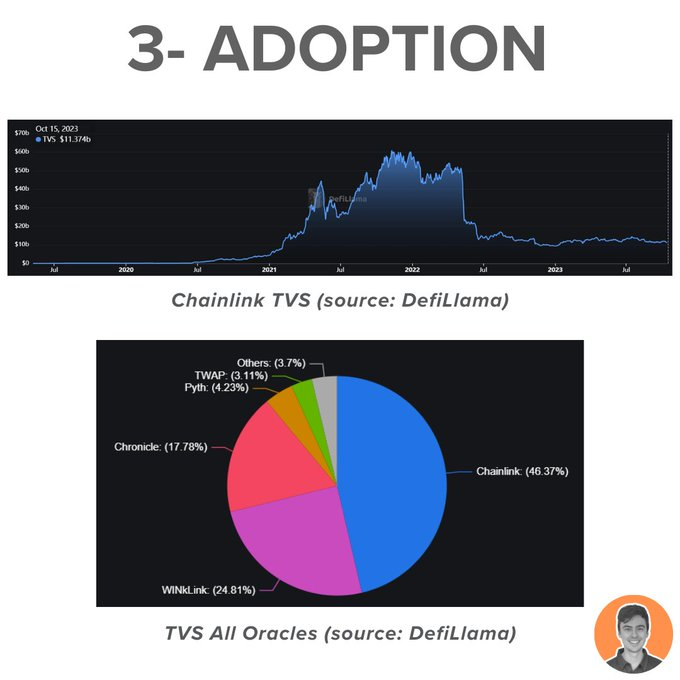

11. Summary

Overall, I am very bullish on $LINK and the Chainlink protocol.

There are a number of upcoming bullish catalysts:

• CCIP

• Chainlink staking

• Economics 2.0

• Institutional adoption

• Ecosystem expanding

• Market conditions improving