Abstract

In 2023, the cryptocurrency market rebounded sharply from last year’s deep bear market. Many individuals may have missed the opportunity to invest. At this time, the Grayscale Trust shares, which still have a discount of about 50% compared to its net asset value (NAV), are particularly attractive.

Based on the position of Ethereum as a core Web3 infrastructure, we are bullish on Ethereum Trust (ETHE), a Grayscale Trust product, rebounding in performance in the potential bull market.

ETHE has a long history of trading at a premium or discount, with the reasons for the positive premium including a lock-up period for subscriptions, higher accessibility than $ETH spot, and lower costs for traditional financial institutions and retail investors compared to self-custody of private keys.

The current reason for the long-term discount is mainly due to the product’s inability to be redeemed directly, similar to the structure of a closed-end fund. Additional reasons include: Restrictions on arbitrage opportunities, forced liquidation by large speculators, discounting of opportunity costs, and the impact of competitive products.

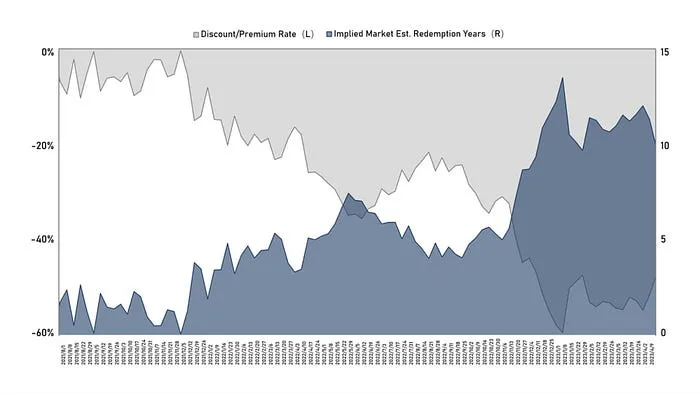

After the discount trend formed in mid-2021, the market’s expectation for ETHE to return to parity has become increasingly longer. According to our calculations, it once exceeded 14 years at the end of last year, and now it has fallen to about 10 years. We believe that this expectation is still too long, and the implied recovery time may fall to less than 2 years when optimistic expectations arrive, which is more reasonable.

There are seven situations that can lead to a narrowing or even disappearance of the discount, including open redemption of $ETH spot (divided into two cases: redemption exemption from SEC and approval of ETF conversion application), obtaining redemption exemptions, product dissolution and liquidation, Grayscale’s own buyback, development of arbitrage strategies and improvement of market confidence, and reduction of opportunity costs to help repair the discount.

Since the birth of ETHE in 2019, the product has not yet gone through a complete “cycle.” We believe that a complete cycle should follow the pattern of premium, parity, discount, parity, and premium. Currently, ETHE has only completed half of the cycle. We believe that if you bet on the potential bull market, ETHE has better resilience. Its performance since the beginning of the year, which is 1.7 times that of $ETH, proves this point.

However, historical data shows that ETHE’s risk-return ratio is subpar, as shown in Table 1, ETHE is almost weaker than ETH/USD in all aspects. This means that if you are ready to hold ETHE for a long time, you may need to adopt some targeted profit-enhancing strategies. Otherwise, there is a risk that its performance will be weaker than the market if the bull market does not quickly arrive.

Summary

In 2023, the cryptocurrency market has once again become the focus of investors’ attention, with BTC and $ETH leading the global asset class in terms of price increases. However, many investors are still unable to recover from the bear market mindset and have missed investment opportunities. But under the Grayscale Trust, investors can still receive a discount of nearly 50% on purchases of GBTC and ETHE products.

As we believe that the Ethereum network ($ETH) will be the core infrastructure of mainstream Web 3 applications in the future, in addition to being able to absorb traditional capital outflows like BTC, it will also have the potential to benefit from Web 3 ecosystem applications. Therefore, this article will focus on the discount phenomenon and potential investment value of the Grayscale Trust product ETHE, and discuss in detail the possible scenarios in which this phenomenon may be reduced or even disappear, as well as the reasons why institutional investors are suitable for entering the cryptocurrency market. In addition, we will analyze the legal structure and potential risks of this product.

The Grayscale Bitcoin Trust was launched as early as September 2013 and is legally designated as a grantor trust. The grantor, who created the trust, is the owner of the assets and property in the trust and retains full control over its assets, which is similar in practice to a closed-end fund. Under this special structure, it allows investors to indirectly own the assets in the trust fund by purchasing beneficial interests. Like closed-end funds, grantor trusts typically do not allow investors to redeem their shares at any time.

The Grayscale Ethereum Trust (ETHE) (formerly known as the Ethereum Investment Trust) (“Trust”) is a statutory trust in Delaware, established on December 13, 2017, and listed for trading in July 2019, adopting the same trust structure as GBTC.

The benefit of using a trust structure is that since the trust does not trade, purchase, or sell $ETH or its derivatives on any exchange, it can avoid being regulated by the corresponding regulatory agencies. This makes it easier to launch the product, although it is still unclear whether $ETH belongs to the CFTC or the SEC.

First, let’s briefly look at the main differences between ETHE and ETH:

Different investment methods

ETHE is a listed trust fund that is regulated by the US Securities and Exchange Commission (SEC), making it easier for institutions to manage their balance sheets. ETHE trades through a regular securities account, which is easier and cheaper than trading on a cryptocurrency exchange. ETHE can be part of an individual retirement account (IRA) and 401(K) (US retirement benefits plan), enjoying investment tax benefits. There is also no need to learn how to manage cryptocurrency wallets, nor to worry about risks such as accidentally losing private keys or wallet exploits.

Different supply

There is no limit to the total supply of ETH. The supply of ETHE depends on Grayscale’s issuance plan.

Different market demand

Since ETHE is an investment product, its market demand is different from that of ETH. Some institutional investors and individual investors may be more willing to invest in ETHE, while ordinary cryptocurrency traders may be more willing to trade ETH.

Others

ETHE investors cannot currently redeem underlying $ETH assets or their equivalent in dollars from Grayscale; ETHE charges a management fee of 2.5% of the net asset value annually; ETHE cannot participate in on-chain activities such as DeFi mining.

Topic 1: Why is there a significant discount?

In theory, the price of ETHE should fluctuate around the value of its $ETH holdings. But in reality, its secondary market price is not fully reflected by the market. Since its listing in 2019, ETHE has historically maintained a premium over $ETH for a long duration, exceeding 1000% at the beginning of its listing in 2019. However, since February 2021, ETHE has entered a discount, which has continued to this day.

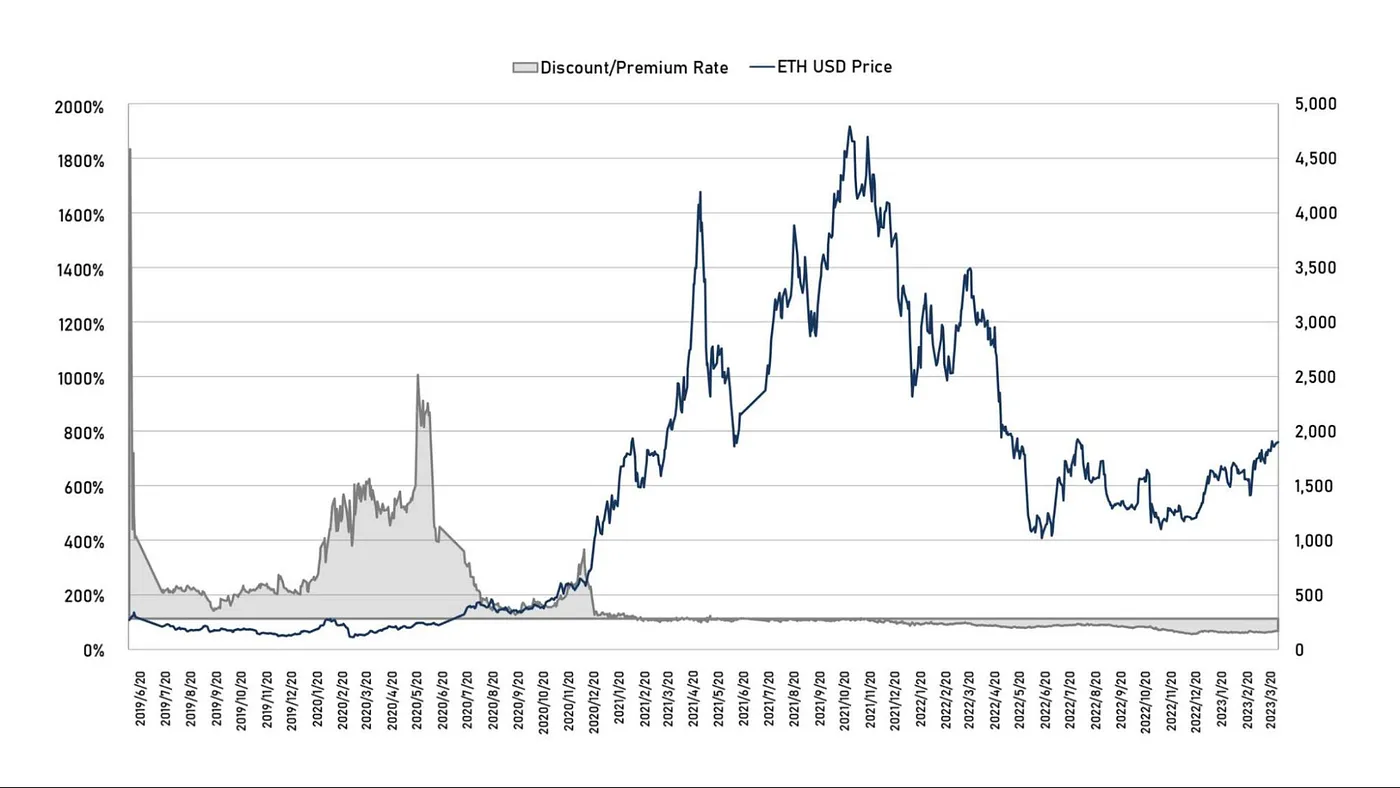

Figure 1: Historical premium/discount of ETHE and $ETH price trend

Grayscale’s crypto trust shares are similar to closed-end funds, which has led to a very limited market supply in the early stages. Secondly, due to the immaturity of the cryptocurrency market, many investors do not know how to buy and store cryptocurrency. Therefore, Grayscale’s crypto trust funds, which can be purchased directly on US stockbroker platforms, are bought at a premium.

As can be seen, the absolute value of the premium of ETHE reached its highest point on June 21, 2019. Until the first discount appeared in February 2021, ETHE traded at a premium on the secondary market. After February 2021, as the market entered a bull market and more index products that track the price of Bitcoin/Ethereum were launched, investors had greater investment options. ETHE began trading on the secondary market at a relatively fairer price compared to its NAV.

On June 29, 2021, GBTC’s application to convert to an ETF was rejected by the SEC, and an hour later, Grayscale sued the SEC, which further widened the discount of ETHE. From mid-2021 to the end of 2022, as the overall cryptocurrency market peaked and weakened, large speculators, led by several failed crypto companies such as Three Arrows Capital (3AC) and BlockFi, were forced to sell fund shares due to high leverage or financial difficulties. Even though the market was at a discount, these speculators could not wait, further expanding ETHE’s discount.

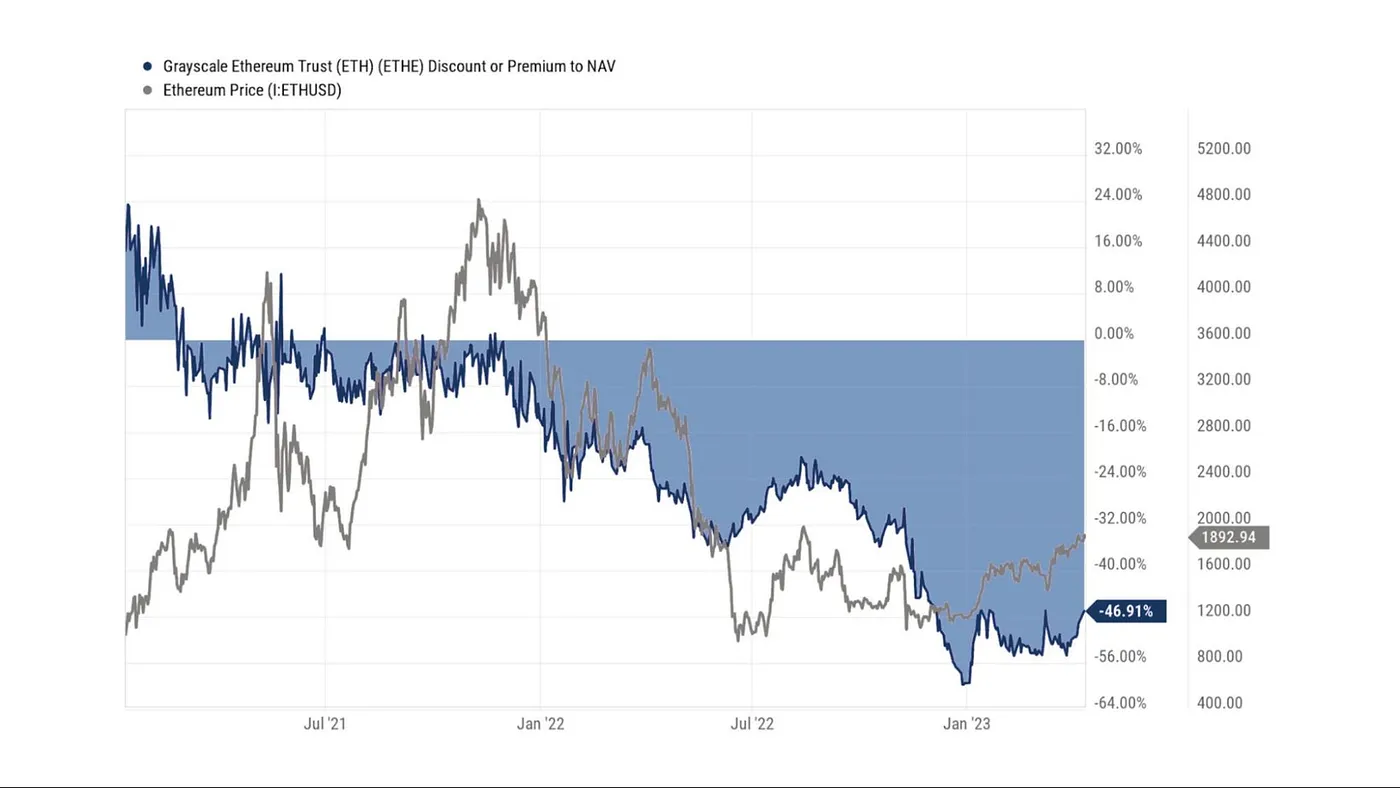

Figure 2: Discount/premium changes since the first appearance of discounts in early 2021 vs. $ETH price trend.

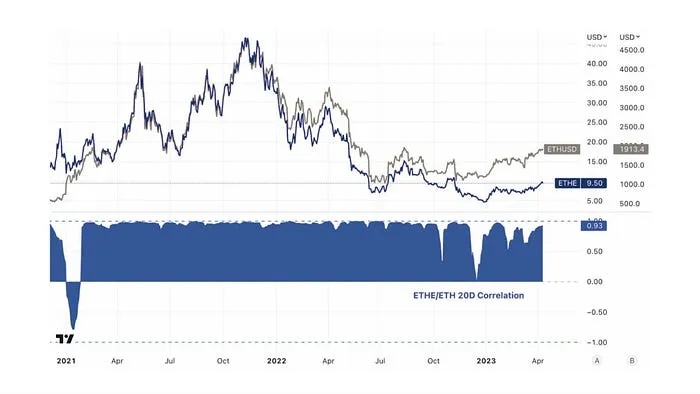

Figure 3: Correlation between ETHE and $ETH prices has been very high for most of the time.

In summary, the reasons behind the premiums/discounts of Grayscale’s ETHE Trust are due to the fund’s structure where assets cannot be immediately redeemed. The reasons for premiums include higher accessibility to the product compared to $ETH spot, making ETHE more suitable for institutional and retail investors in traditional finance who do not want to manage their own private keys; balance sheet accounting treatment, tax advantages, and helping investors bypass compliance-related issues. The reasons for negative premiums are related to four factors: Fund structure where assets cannot be directly redeemed, restrictions on arbitrage opportunities, discounted opportunity costs, and the impact of competitive products. These will be discussed in more detail in the following sections.

1/ Fund structure where assets cannot be directly redeemed

According to legal documents, only authorized participants (AP) authorized by Grayscale can directly purchase and redeem $ETH from Grayscale. APs must meet certain eligibility and regulatory requirements, including being registered brokers or dealers, and must meet specific regulatory standards. According to the rules, each trust share is grouped by 100 shares, and APs need to purchase at least one group at a time and can only exchange it with $ETH spot.

So far, there are only two APs. Before October 3, 2022, Genesis Global Trading, Inc. under DCG was the only AP, and after October 3, 2022, Grayscale Securities took over as the other sole AP of the trust.

Therefore, it can also be understood that Grayscale plays the role of the primary dealer, and other investors can only purchase the shares flowing out of their hands. Therefore, although some institutions may be able to purchase ETHE at original price in the primary market, they are not direct subscribers. According to the rules, they have no right to request redemption. As for why these institutions do this, there may be two main reasons: one is to see the arbitrage opportunity in the secondary market, and the other is to treat Grayscale as a custodian to avoid the risk and cost of managing their private keys.

Currently, the trust fund does not have a share redemption plan in operation, so APs and their clients cannot redeem shares through the trust fund. Therefore, participants cannot use the arbitrage opportunities generated by the deviation of the secondary market price from the net asset value per share of the trust’s $ETH holdings. This makes it difficult for the price difference to recover when a discount occurs. If direct redemption is possible, market participants can purchase trust shares at a low price in the secondary market and then redeem higher-value $ETH from the fund, pushing the discount to narrow.

2/ Restrictions on arbitrage opportunities

The inability to directly subscribe and redeem ETF shares creates restrictions on arbitrage opportunities. This does not pose a significant obstacle during a bull market when ETHE is trading at a premium, but becomes more apparent during a bear market when it trades at a discount.

In traditional ETF markets, arbitrage opportunities arise when demand for an ETF increases or decreases and the market price deviates from its net asset value. Such mispricing is often corrected quickly through arbitrage.

There are two main types of arbitrage: basic arbitrage, which is aimed at ETF shares that can be subscribed and redeemed quickly, and CTA strategy arbitrage, which is aimed at ETFs that cannot be subscribed and redeemed quickly.

Basic arbitrage

In the case of a premium, investors will subscribe to ETF shares from the fund issuer and then sell them on the secondary market for arbitrage purposes; this will decrease the demand/price of the ETF.

In the case of a discount, investors will buy the ETF on the secondary market and then redeem them for a higher value from the fund issuer; this will increase the demand/price of the ETF.

CTA strategy arbitrage

For ETFs that are difficult to subscribe or redeem in a timely manner, one can bet on the price difference between the underlying assets and the ETF shares. When the premium reaches a certain level, investors will go long on the underlying assets and short the ETF shares; when the discount reaches a certain level, investors will short the underlying assets and go long on the ETF shares.

The implementation of this strategy is affected by the price convergence trajectory. In the case of ETHE, because price regression depends mainly on regulatory judgments rather than certain operations of market participants (such as subscription / redemption), uncertainty is high, resulting in a higher tolerance for market price differences.

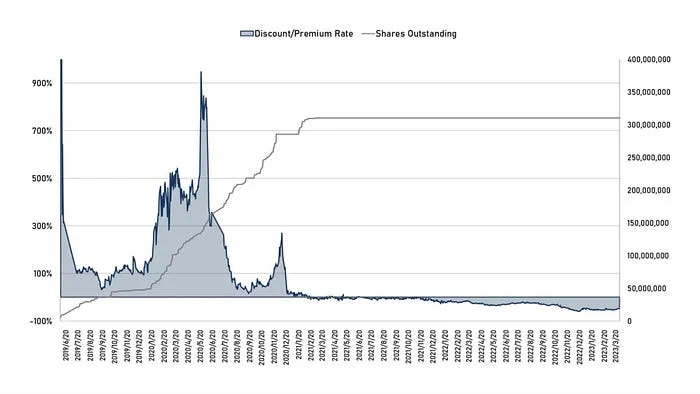

Figure 4: ETHE historical discount/premium rate vs. circulating share quantity

From figure 4, it can be seen that after Spring 2021 where the premium narrowed, the forward arbitrage space disappeared, the buying power of new trust shares also subsequently stopped.

There is also a classic case of a similar closed-end fund that cannot be redeemed in the traditional market. This is the stock of Berkshire Hathaway, the stock of the legendary trader, Warren Buffett. As an investment company, Berkshire Hathaway’s stock price may be affected by the price fluctuations of the company’s equity holdings in its investment portfolio. However, ordinary investors cannot demand that Berkshire Hathaway redeem its assets or apply for new shares in the company at any time.

However, for several decades, the stock of Berkshire Hathaway has been traded at a premium higher than its net asset value, mainly due to the successful investment record and market positioning of the company’s founder, Warren Buffett. However, at certain times, the premium of its stock may decline, reflecting changes in the market’s view of the company.

For example, in March 2020, the stock of Berkshire Hathaway fell by about 30%, resulting in a significant discount in the trading price of the company’s stock. This discount may mainly reflect market concerns surrounding COVID-19 and Berkshire Hathaway’s exposure in epidemic-affected industries such as tourism, aviation, and finance.

Returning to ETHE: After the primary suscription, ETHE can only circulate on the secondary market after holding for at least 6 months. Therefore, the path of forward premium arbitrage does exist but requires more time. However, after ETHE first appeared at a discount in February 2021, investors’ primary market purchase behavior stagnated. This is obviously because the backward discount arbitrage requires redemption support, while the timetable for Grayscale to open this is unclear. In the case where the investment strategy of ETHE has no greater advantages than holding spot positions, its closed-end shares are difficult to return to a premium like the stock of Berkshire Hathaway.

Secondly, as the overall cryptocurrency market peaked and weakened, institutional sellers, such as Three Arrows Capital (3AC) and BlockFi, several large speculators led by failed cryptocurrency companies, previously made large purchases and waited six months to sell for profit from the huge premiums of GBTC and ETHE. Later, due to high leverage or financial difficulties, they were forced to sell fund shares even if the market was trading at a discount at that time. For example, it can be seen from publicly available information that DCG was forced to sell about 25% of its ETHE holdings at half price earlier this year due to financial problems, which amplified the discount of ETHE.

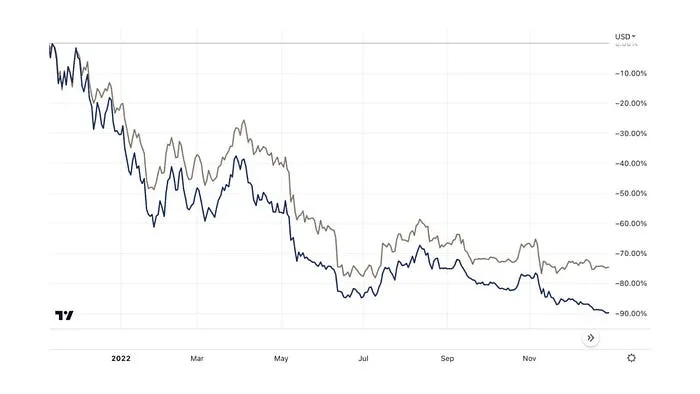

Figure 5: Comparison of the performance of ETHE and $ETH from the mid-high point in 2021 to the end of 2022:

3/ Discounted Opportunity Cost

Table 1: ETHE Related Legal/Financial Information (As of March 31, 2023)

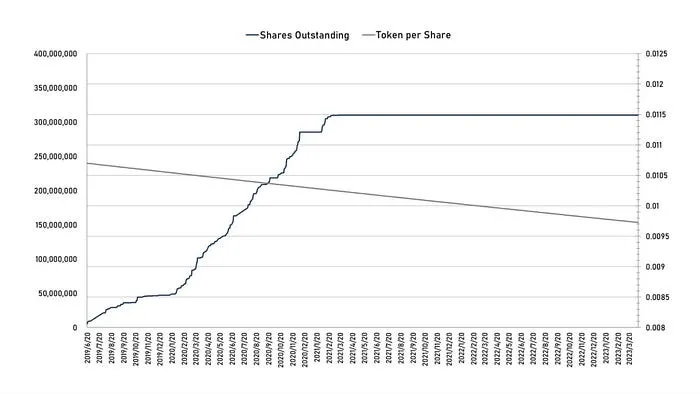

The management fee for Grayscale’s Ethereum Trust is 2.5% of the net asset value (NAV) annually. Grayscale deducts the estimated accrued but unpaid fees of the trust from its $ETH holdings daily in public data, so the amount of $ETH represented by each ETHE share gradually decreases, as shown in the graph below.

Graph 6: Number of ETHE shares in circulation (left) vs. the amount of $ETH held by the trust per share (right)

If we disregard other risks, today’s discount can be understood as a discounted opportunity cost. Therefore, based on the secondary market discount rate X and the holding opportunity cost Y, we can calculate the implied market expectation of the time T required for redemption or NAV parity recovery. We assume that the potential growth expectation of NAV is 0 and:

Holding Opportunity Cost + 10-year US Treasury Yield + 2.5% Management Fee, then: (1-Y)^T=1+X

Therefore, T=ln(1+X)/ln(1-Y)

Graph 7: Historical discount rate of ETHE vs. Implied market expectation for redemption (recovery to parity) time (unit: years)

From the chart above, it can be seen that the market’s expectation for ETHE to return to parity has become longer since the formation of the discount trend in 2021. At the end of last year, it exceeded 14 years due to regulatory crackdowns and a quiet market. Now, it has fallen to around 10 years. However, we believe that this expectation is still too long. It is reasonable to expect that the implied recovery time may fall below 2 years when optimistic expectations arise. The most pessimistic outcome may take more than 10 years to liquidate and dissolve, as Mt.Gox’s asset liquidation took 9 years.

4/ Impact of Competitive Products

Before 2019, there were few competitors to Grayscale’s trust products in the market. On February 18, 2021, the Purpose Bitcoin ETF, a Canadian fund that directly invests in Bitcoin, officially began trading and quickly accumulated over $1 billion in assets within a month. Its management fee of 1% is less than half that of GBTC, and its ETF structure can more closely track Bitcoin, making it more attractive than Grayscale’s products.

Just two months later, on April 17, the Canadian regulatory agency approved three Ethereum ETFs at the same time, namely the Ethereum ETF (ETHH) from Purpose Investments, the Ethereum ETF (ETHR) from Evolve Capital Group, and the Ethereum ETF (ETHX) from CI Global Asset Management, all of which were listed on April 20. According to the official websites of the three companies, there is a slight difference in the management fees of the three Ethereum ETFs, with CI Global’s management fee at 0.4%, Evolve’s at 0.75%, and Purpose Investments’ at 1%. On the first day of listing, Purpose’s Ethereum ETF attracted CAD 26.46 million (approximately USD 21.32 million) in funds, Evolve’s ETHR raised CAD 2.22 million (approximately USD 1.79 million), and CI Global’s ETHX had an asset size of CAD 2.25 million (approximately USD 1.81 million).

Three days later, on April 23, the fourth Ethereum ETF in Canada began trading on the Toronto Stock Exchange. It was jointly launched by Canadian digital asset management company 3iQ and investment company CoinShares, and offers trading of Canadian dollar shares (ETHQ) and US dollar shares (ETHQ.U).

In addition, there are more $ETH futures ETFs, related stocks, listed companies holding $ETH, mining and asset management businesses, etc. The increasing market share of these diversified investment channels weakens Grayscale’s trust products’ scarcity to traditional financial institutions and retail investors, becoming a competitive factor that Grayscale must consider.

Topic 2: When discounts may be reduced or eliminated

There are seven situations that can cause discounts to narrow or even disappear, including the opening of $ETH spot redemptions (divided into two situations of obtaining SEC exemptions through redemption and ETF conversion application approval), obtaining redemption exemptions, product dissolution and liquidation, Grayscale’s own repurchases, the development of arbitrage strategies and the improvement of market confidence, and the decrease in opportunity costs that contribute to discount repairs.

1/ Improvement of regulatory environment — ETF application approval

According to Grayscale’s latest FORM 10-K filing released at the end of 2022, they still believe that their trust can carry out redemption plans after obtaining SEC approval for ETF conversion. Although the SEC has rejected the application to convert GBTC to an ETF, a federal appeals court judge in the United States questioned in March of this year whether the agency’s decision was correct, as it had previously approved Bitcoin futures ETF products.

It should be noted that Grayscale currently only applied for ETF conversion for the Grayscale Bitcoin Trust (GBTC) and has not yet announced plans to convert the Grayscale Ethereum Trust (ETHE) into an ETF. However, recent progress is undoubtedly positive. At the most recent hearing held on March 7th of this year, Grayscale argued that the standards applied by the SEC were inconsistent, as they had approved the application for Bitcoin futures ETFs but had consistently rejected applications for spot Bitcoin ETFs.

Grayscale believes that since the underlying assets of these two products are the same and their prices are derived from Bitcoin, Wall Street regulators should treat these products similarly, though that is not the case. Grayscale claims that the regulator’s behavior is arbitrary and capricious, and therefore violates federal law. The SEC responded that it has been applying the same standards, but the products are actually different. According to the SEC, the Bitcoin futures market is regulated by the CFTC, which makes it different from spot BTC ETFs, which they believe are unregulated.

Before the hearing, Bloomberg analyst Elliot Stein believed that the SEC had the upper hand in the lawsuit, and their chances of winning were much higher than those of the GBTC issuer because the court tends to defer to federal agencies as they are experts in their respective fields. However, after hearing the latest arguments, Elliot Stein believes that Grayscale has a 70% chance of winning. If GBTC is approved, it will also directly benefit the sentiment of ETHE. However, it should be noted that unlike BTC-based futures ETFs that have been approved for listing by the SEC, no funds based on Ethereum have been approved for listing yet, which is related to the disputed legal status of Ethereum.

2/ Improvement in regulatory environment — becoming a registered investment company or being classified as a commodity

Grayscale Ethereum Trust (ETHE) is a registered investment trust, not a registered investment company. Specifically, it is established as a trust under the laws of a specific state and is registered under the exemption provisions of the 1933 Securities Act with the US Securities and Exchange Commission (SEC). This means that ETHE is not required to comply with certain requirements under the 1933 Securities Act, such as disclosing information to the public and registering.

However, if the SEC determines that the trust needs to register as an investment company under the Investment Company Act of 1940, Grayscale believes that in this case, the trust structure could be dissolved and its shares may be converted to stocks, but this is only speculation and will ultimately depend on the specific circumstances of the company and regulatory opinions, as well as exchange rules.

In addition, if ETHE is classified by the CFTC as a commodity investment portfolio, it would need to comply with the relevant provisions of the Commodity Exchange Act (CEA) and register and be regulated by the CFTC. This is also a possible regulatory direction.

3/ Obtaining redemption exemptions

Grayscale once provided a redemption program, but it was halted in 2016 after the SEC accused Grayscale Trust of violating Regulation M. Specifically, the SEC was concerned that Grayscale Trust may conduct share redemptions while creating new shares, which could affect market prices and lead to market manipulation, insider trading, or unfair trading practices. Therefore, Grayscale suspended the GBTC redemption program, and subsequent trust funds such as BCH and ETHE also followed this operation to ensure that their trading practices comply with applicable regulations and regulatory requirements.

As Grayscale does not currently believe that the SEC will consider continuous redemption programs, the trust has not sought regulatory approval from the SEC.

However, it is not ruled out that they may actively seek this exemption in the future, although the timing and probability of success are uncertain. Moreover, developing redemption assets would reduce Grayscale’s income as a trustee, so currently there may be insufficient motivation for them to actively pursue an exemption.

If such an exemption is obtained and Grayscale agrees to redemption, a redemption program can be implemented. The redemption program will provide authorized participants (APs) with arbitrage opportunities when the Trust’s share value deviates from the value of $ETH holdings, minus fund expenses and other liabilities. This arbitrage opportunity may be monopolized by APs or transferred to clients, and it is currently unclear because only Grayscale’s affiliated companies serve as exclusive APs, which may raise concerns about unfair competition.

4/ The relationship between discount and market sentiment, the development of arbitrage strategies, and market confidence.

In the previous section, we discussed the problem of the discount not closing significantly due to the use of arbitrage being blocked. However, on the other hand, due to the existence of CTA strategies, even if it cannot be redeemed at present, arbitrage traders may still compress the discount when the overall cryptocurrency market is on a positive trend. Since the birth of ETHE in 2019, the product has not yet experienced a complete “cycle”. We believe that a complete cycle should follow the pattern of premium → parity → discount → parity → premium. Currently, the ETHE product has only completed the first half of the cycle.

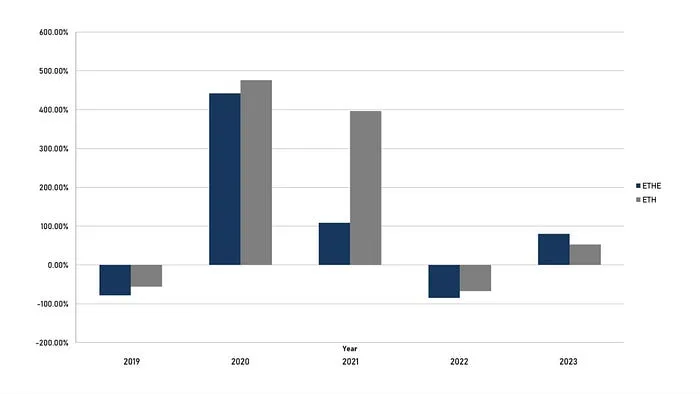

Figure 8: Annual Return ETHE Vs. $ETH (it can be seen that ETHE’s long-term performance on an annual basis is inferior to $ETH).

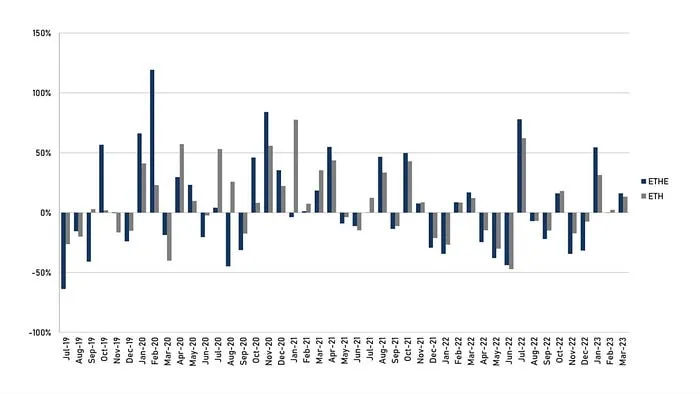

Figure 9: Monthly Return ETHE Vs. $ETH (it can be seen that ETHE has greater elasticity than $ETH in the short-term).

As can be seen from the comparison of annual and monthly returns in the above figures, 2019–2022 belongs to the “premium → parity → discount” cycle, which can be understood as a bubble-bursting cycle. ETHE does not have excess returns during this period, and investment is not a good choice. However, due to the fact that the ETHE product has greater elasticity than $ETH itself, it should create better positive returns in the future “discount → parity → premium” repair cycle. In fact, this can be clearly seen from the performance comparison in the past three months this year, where the increase in ETHE is 1.7 times that of ETH.

5/ Inability to Convert ETFs nto Final Trust Liquidation

If Grayscale is unable to obtain redemption exemptions or approval for ETF conversion and this situation persists for too long, the continuous fees deducted by the fund management may cause dissatisfaction among investors, and Grayscale will face significant pressure to liquidate and dissolve the trust. Once liquidation is confirmed, the discount on NAV in the secondary market may quickly recover.

In fact, Alameda Research, a subsidiary of the bankrupt FTX, has already sued Grayscale Investments and its owner DCG Group in March 2023, attacking Grayscale for charging high fees and refusing to allow investors to redeem from GBTC and ETHE. Alameda claims to be suffering “hundreds of millions of dollars in losses” due to this structure. Similar situations may become more and more frequent over time.

In addition, according to the declaration document, the main situations that may trigger the early termination and liquidation of the ETHE Trust include:

Federal or state regulators in the US requiring the Trust to close or force the Trust to liquidate its $ETH, or seize, confiscate or otherwise restrict the Trust’s assets;

If CFTC or SEC, FinCEN and other regulatory agencies believe that the Trust needs to comply with specific laws and regulations, Grayscale may choose to dissolve the Trust to avoid unnecessary legal liability and financial risk;

Grayscale believes that the Trust’s assets and fees are not proportional to the risks, costs, and returns;

The Trust license is revoked;

Anything that stops the Trust from accurately figuring out the Index Price, or if it’s just too difficult for the Trust to do so;

Anything that makes it difficult or impossible for the Trust to convert Ethereum into U.S. dollars;

The custodian resigns or is dismissed and there is no replacement candidate;

The Trust becomes insolvent or bankrupt.

6/ Grayscale’s Self-Repurchase

In the event of an extreme scenario where Grayscale is willing to buy back all outstanding shares in the market at a cost below NAV and decides to privatize or liquidate the Trust, such an operation is obviously profitable. Announcing a large repurchase plan can help boost market confidence and may be conducive to narrowing the discount.

Grayscale’s parent company, Digital Currency Group, announced a total of up to US$1 billion in Trust share repurchase plans in 2021–2022. However, GBTC still trades at a price below NAV, which may be because the scale of repurchase is relatively insignificant compared to the overall asset management scale of hundreds of billions of dollars, although secondary market repurchase helps to narrow the price spread.

In addition, in Grayscale CEO Michael Sonnenshein’s year-end letter to investors in 2022, he mentioned that if the GBTC ETF is not realized, one of the methods for investors to unlock it is a tender offer, such as repurchasing no more than 20% of the outstanding shares of GBTC. If this happens, it should consider all of its trust products, and the discount on ETHE may also narrow.

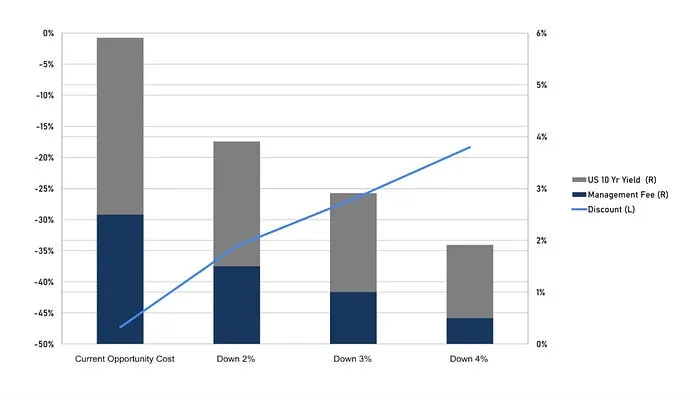

7/ Opportunity cost reduction

According to our discussion in Topic 2, the current discount can be understood as the present value of opportunity cost. Therefore, if Grayscale reduces management fees or the risk-free interest rate in the market drops, it will help narrow the discount based on the same expected time for the recovery of parity. In fact, Grayscale’s CEO Sonnenshein mentioned the possibility of reducing fees in March this year.

Even if the expected period of 10.5 years remains unchanged, simple simulations can be conducted:

If the 10-year government bond and management fees both decrease by 1 percentage point, the opportunity cost is an annualized 3.91%, which can help narrow the discount from -47.3% to -34.2%;

If they both decrease by 1.5 percentage points, the opportunity cost is an annualized 2.91%, and the discount may narrow to -26.7%;

If they both decrease by 2 percentage points, the opportunity cost is an annualized 1.91%, and the discount may narrow to -18.35%.

Figure 10: Simulation of discount narrowing that may be caused by a drop in the risk-free interest rate

Topic 3: Why is it suitable for professional investors to bet on the cryptocurrency market

1. Grayscale’s digital currency trust products have advantages in accessibility, balance sheet management, cost advantage compared to self-custody of private keys, and investment tax advantages. As of now, ETHE is still the only “stock” in the US market that uses Ethereum spot as its main asset.

Specifically:

Accessibility:

Grayscale’s digital currency trust shares can be traded through common US stock brokers, which means that investors can buy and sell these products more easily. In contrast, trading through cryptocurrency exchanges or other channels may involve more risks and fees.

Balance sheet management:

Grayscale’s digital currency trust products are a type of security product, which means that professional investors do not have to worry about how to manage their digital assets on the balance sheet and can more easily incorporate them into their investment portfolios.

Custody cost advantage:

Compared to self-custody of private keys for digital currencies, Grayscale’s digital currency trust products may have lower costs. For example, when buying digital currency on-chain, investors may need to bear higher learning costs and network fees. There may also be a risk of leakage when safeguarding private keys, with the possibility of completely irretrievable assets once lost. When buying and selling Grayscale’s digital currency trust products, investors only need to pay commissions and fees related to securities transactions.

Investment tax advantages:

According to US tax law, Grayscale’s digital currency trust products are considered securities products and may enjoy the same investment tax benefits as other securities products. For example, if an investor sells Grayscale’s digital currency trust products after holding them for more than a year, they may be eligible for lower capital gains tax rates.

2. If betting on a potential bull market, ETHE has higher elasticity:

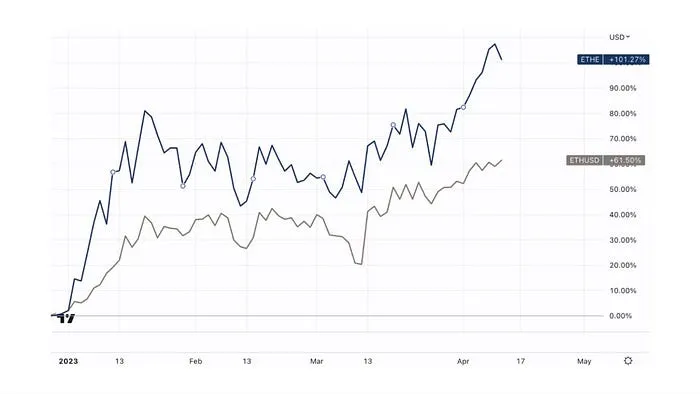

Since the rebound of the bull market since the end of 2022, ETHE has increased by up to 107%, far higher than $ETH’s 61%, which shows that a considerable number of pessimistic factors have been taken into account during the discount cycle. Therefore, when the market rebounds, ETHE has greater elasticity than $ETH and is a better bet for the bull market.

Figure 11: Comparison of the rise since the end of 2022 between ETHE and ETH.

Theme 4: Risks of ETHE investment

1/ Policy and regulatory risks

The recognition of $ETH or any other digital asset as a “security” may have an adverse impact on the value of $ETH and the stock;

Any jurisdiction that restricts the use of $ETH, verification activities or the operation of the Ethereum network or digital asset markets may have an adverse impact on the value of the stock;

Regulatory changes or interpretations may require the Trust to register and comply with new regulations, which may result in additional expenses for the Trust;

Because Grayscale’s affiliated companies are the only entities that can create or destroy fund shares, the number of issuances and redemptions may not be efficiently adjusted based on market demand due to regulatory restrictions or technical reasons, which could result in significant deviations of the secondary market trading price from NAV.

2/ Statistical risks

Historically, the risk-return ratio of ETHE has been poor, as shown in Table 2, with ETHE performing weaker than ETH/USD in almost all aspects. This means that if you plan to hold ETHE for the long term, you may need to implement targeted profit-enhancing strategies. Otherwise, there is a risk that its performance may be weaker than the market if the bull market does not arrive quickly.

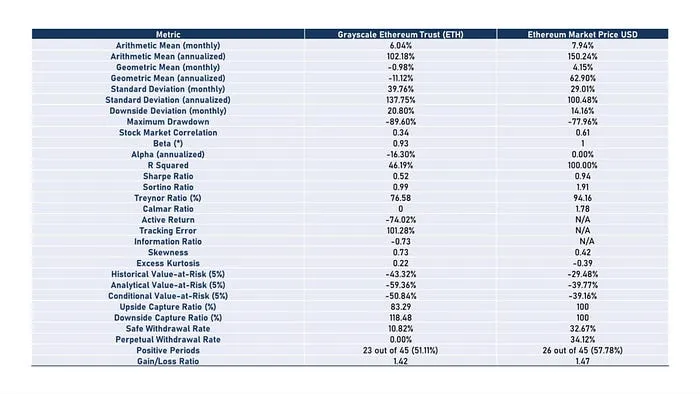

Table 2: Risk and Return Metrics (Jul 2019 — Mar 2023)

Return:

Whether it’s the arithmetic or geometric mean monthly or annualized return, $ETH outperforms ETHE. In particular, the annualized return for Ethereum reached 150.24%, while Grayscale Ethereum Trust was only 102.18%. In terms of annualized geometric mean return, Ethereum reached 62.90%, while Grayscale Ethereum Trust was -11.12%.

Risk-adjusted returns:

Looking at risk-adjusted return indicators such as the Sharpe ratio, Sortino ratio, and Treynor ratio, ETHE’s performance after adjusting for risk is weaker than that of ETH.

Volatility:

ETHE’s volatility (standard deviation) is higher at 137.75%, which means investors may face greater price volatility risk. In contrast, $ETH has lower volatility at 100.48%.

Maximum drawdown:

ETHE’s maximum drawdown reached -89.6%, higher than Ethereum’s -77.96%, which means that in past performance, ETHE suffered greater losses at its worst.

Active returns and information ratio:

ETHE’s active returns were -74.02%, and the information ratio was -0.73, which means that compared to Ethereum, Grayscale Ethereum Trust’s performance in active management is poor. Although this can be attributed mainly to price fluctuations in the secondary market as the fund’s holdings did not decrease due to active trading.

In the second article of the series, we will discuss how to enhance returns for ETHE to ensure that it can withstand bull and bear markets.